Table of Content

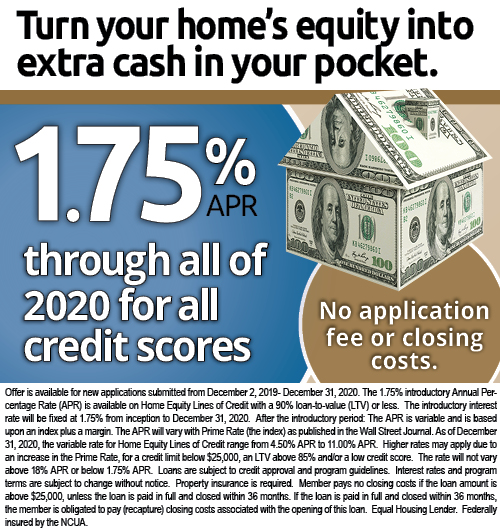

Reduce monthly payments, your rate or put your home's equity to good use. DCU offers fixed and adjustable-rate mortgage loans to help you choose the refinance option that's right for your financial goals. Some HELOCs, including DCU’s, have a feature that allows the borrower to draw an amount against the line of credit and convert it to a fixed-rate loan with a defined repayment period. The fixed rate would be determined by market rates when the conversion is made.

Prequalifications and preapprovals are two ways to verify if a potential borrower can afford a mortgage. Borrowers apply for prequalification while they are searching for a home. Prequalification allows you and sellers to estimate how much you can afford. At DCU, prequalification is the initial step to applying for a mortgage for home purchase. The DCU HELOC product is exactly what I was looking for. For short-medium term borrowing for home improvement expenses to the option of 2 fixed larger loans, this product offers comprehensive and flexible options.

Certificate Accounts

In addition, you may also forward the phishing email to "". Our fraud experts will help determine the origin and shut down these fraudulent attempts to unlawfully gain personal information. If DCU does not meet a borrower’s needs, there are other institutions that might. Since DCU’s branches are limited to Massachusetts and New Hampshire, borrowing from them might not appeal to people in other parts of the country who want to deal with someone in person.

DCU explains how cash-out refinancing works and when it makes financial sense. Keep in mind that things like your appraisal or a delay in providing necessary documentation may slow down the process. Choose from our easy to use calculators to plan for your mortgage refinance. Verification of Deposit Letter - Request a Verification of Deposit letter verifying your account balance and history. Account Activity Letter - Generate a printable letter with details of account activity. Just click on the application and follow the instructions.

DCU Alternatives

As the name suggests, a fixed rate stays the same for the life of the loan. That also means the monthly payments are the same for the entire loan. A fixed-rate loan product that uses the equity in your home to provide a "lump sum" loan amount you pay down with fixed monthly payments over a set period of time. It's ideal for a one-time home improvement project, large expenses or purchases.

Qualified borrowers can finance up to 125% of the value determined by the purchase and sales agreement with conversion details and their value. Qualified borrowers can finance up to 125% of NADA book value or up to 125% of the purchase price, whichever is less. Enjoy a low interest rate which adjusts periodically after the initial term. Reach out to our Mortgage Team and someone will respond as soon as possible. For security purposes, please do not share personal financial information in the email. Simple Online Application– Compare mortgage options and apply in minutes with our streamlined quote and application process.

Membership Required

However, the repayment term is usually fixed and when the term ends, you may be faced with a balloon payment – the unpaid portion of your loan. A specific amount of credit is set by taking a percentage of the appraised value of the home and subtracting the balance owed on the existing mortgage. Income, debts, other financial obligations, and credit history are also factors in determining the credit line. Annual Cash Back payments are limited to an aggregate of $25,000 for each tax-reported owner.

Some homeowners prefer to borrow against their property’s actual value. They usually borrow only a percentage of the value of their homes because this option allows them to lock in their interest rate even if the real estate market or the economy fluctuates. Another advantage of borrowing against one’s home’s value is that homeowners can usually get low interest rates while they still have an active loan with a fixed-rate home loan. The estimated monthly payment on a 48-month certificate-secured loan with an APR of 3.90% would be $22.53 per $1,000 borrowed. Loan must be paid in full prior to the certificate maturity date. Certificate rate used in this example is for illustrative purposes only and is subject to change at any time.

Home Mortgage Loans

Please do not include any confidential information when using this form such as your Social Security number, account number, your PIN, date of birth, etc. For secure email, log into Online Banking and choose Contact Us. At Bills.com, we strive to help you make financial decisions with confidence. For more information regarding Bills.com’s relationship with advertised service providers see our Advertiser Disclosures.

The advertised rates are for non-confirming loans and reflect the lowest available rate based on the loan assumptions noted below. The advertised rates are for conforming loans and reflect the lowest available rate based on the loan assumptions noted below. A Fixed Rate Mortgage is a loan with a set interest rate and equal monthly principal and interest payments for the entire term of the loan. Credit union HELOC rates are often lower than rates at banks, which helps keep your monthly payments low. Credit unions focus on bringing the best value to members through competitive rates and low fees.

DCU is a not-for-profit, member-owned credit union that puts you first. And unlike banks, we don’t answer to the needs of stockholders. This loan appeals to buyers who plan to move or refinance in the short term. Our Mortgage Learning Center will help you gain a better understanding of the mortgage process – from prequalification to keys in hand. It is not intended to serve as legal, financial, investment or tax advice or indicate that a specific DCU product or service is right for you. For specific advice about your unique circumstances, you may wish to consult a financial professional.

When you have completed the application, click submit and your information will be reviewed for approval. If you don’t have time to complete the application right now or if you need to gather information before you finish, we’ll save the information you have completed. When you’re ready to finish, return to the site and enter your User ID and password to continue. We’ll ask you questions about your personal finances and the home. You’ll probably know all the answers off the top of your head.

If you wish to apply for dcu home equity loan using the internet, there are certain things that you must look out for. First of all, it is important that you get hold of a reference page from a reputable online provider likepg action planner. You will know whether the reference page is credible or not when you see this reference page. See if there are testimonials provided from previous customers who have obtained dcu home equity loan using the same source. You can also check for contact details of these previous customers.

No comments:

Post a Comment